HPF app for iPhone and iPad

Developer: Managing Partners Capital Limited

First release : 13 May 2016

App size: 7.21 Mb

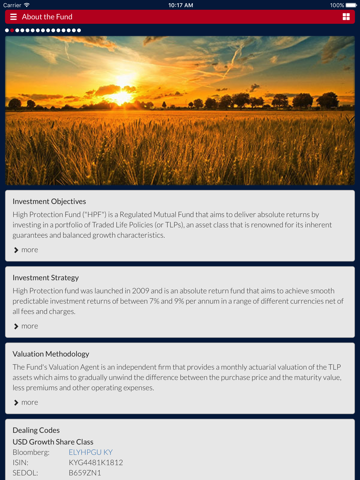

High Protection Fund ("HPF") is a registered mutual fund that aims to provide Investors with an opportunity to benefit from the potential capital growth from investment in Traded Life Policies ("TLPs") and or traded policies funds ("TLP Funds") and securitisations being any number of international or exempt international schemes that invest in TLPs.

TLPs (or Life Settlements) are US-issued life insurance policies sold before the maturity date at a deep discount from their fixed maturity values. Life expectancies are estimated using population mortality statistics and evidence of the assureds health.

Managing Partners Investment Management Limited applies an actuarial valuation methodology that gradually unwinds the difference between the purchase price and maturity value (less premiums and expenses) of the policies with the objective of delivering predictable investment returns.

HPF may also invest in other asset classes from time to time including but not limited to cash or near cash assets.

The investment strategy team of HPF convenes on a monthly basis and has worked closely with the custodian trustee, the securities intermediary and valuation agent to review the current assets of the Fund and to specify appropriate buying criteria. Consideration is given to, amongst other criteria, liquidity, weighting by insurance companies and purchase criteria.

Subscriptions into the HPF Growth and GrowthPlus Share Classes can be made in USD, EUR, GBP, CHF and CZK subject to any set minimum of the respective share class.

Key Functionality Points:

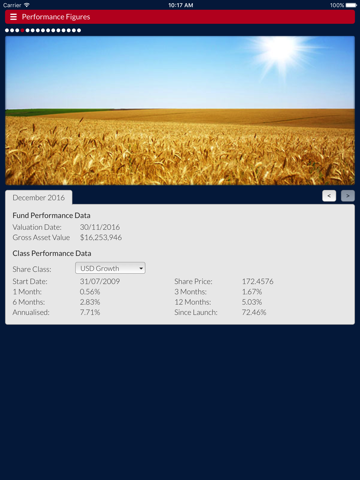

- Detailed fund performance figures

- Interactive graph and charting sections

- Comprehensive fund information

- Fund Fact Sheets

- Background information on Directors, Partners and Service

Providers

- In the Media section with links to relevant property related articles

- Member section containing complete fund literature set